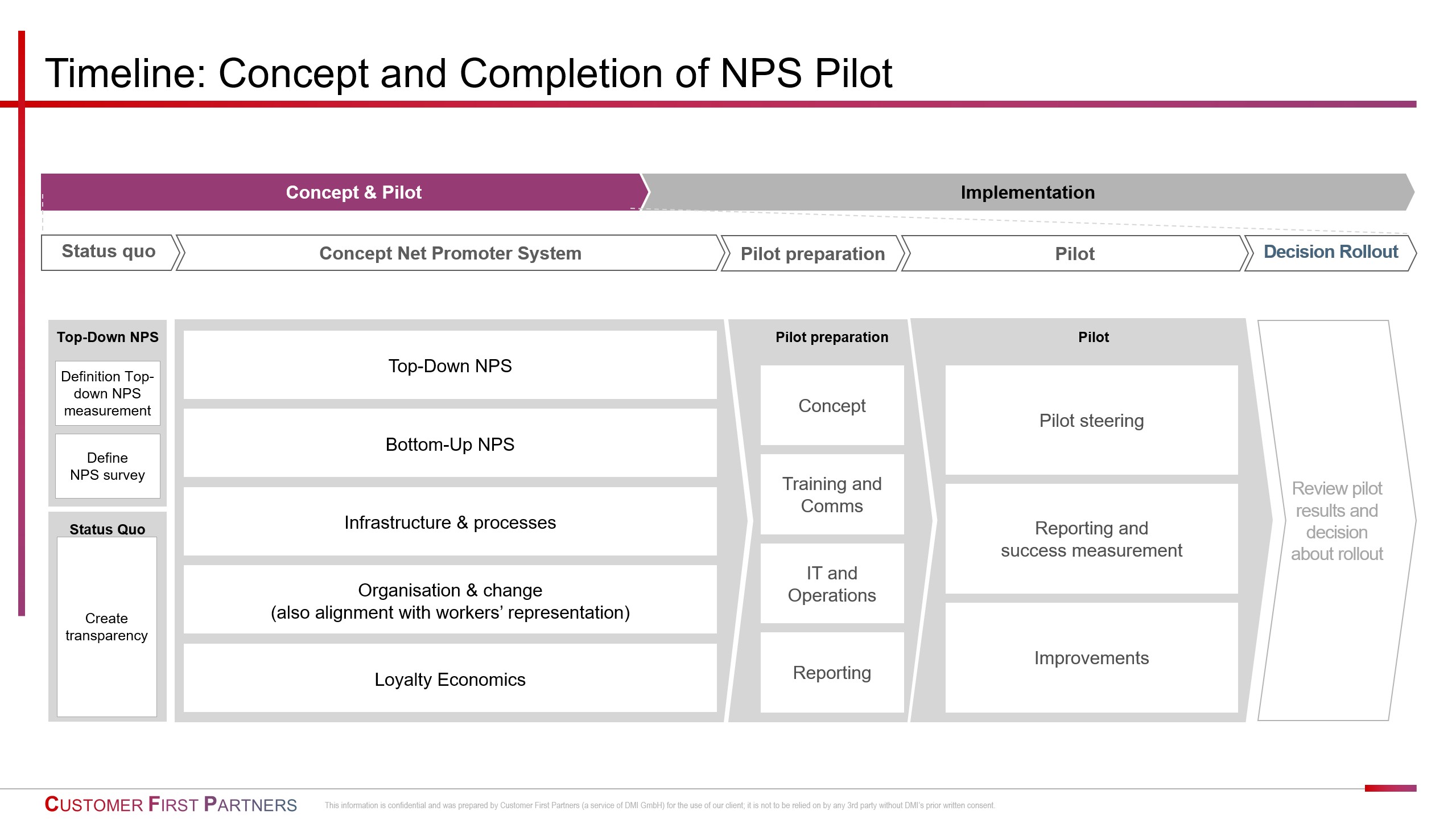

Starting Point & Challenge

To establish a structured and sustainable customer feedback system, we supported the bank in:

Results Achieved

Short-Term (3-6 months)

Mid-Term (6-12 months)

Long-Term (12+ months)

This project successfully embedded a customer-first mindset within the bank’s operations, positioning it for long-term success in a competitive financial landscape.